The Chinese Investors are coming, ~9% price jump in 6 weeks!

Feb 28 2011 w8c

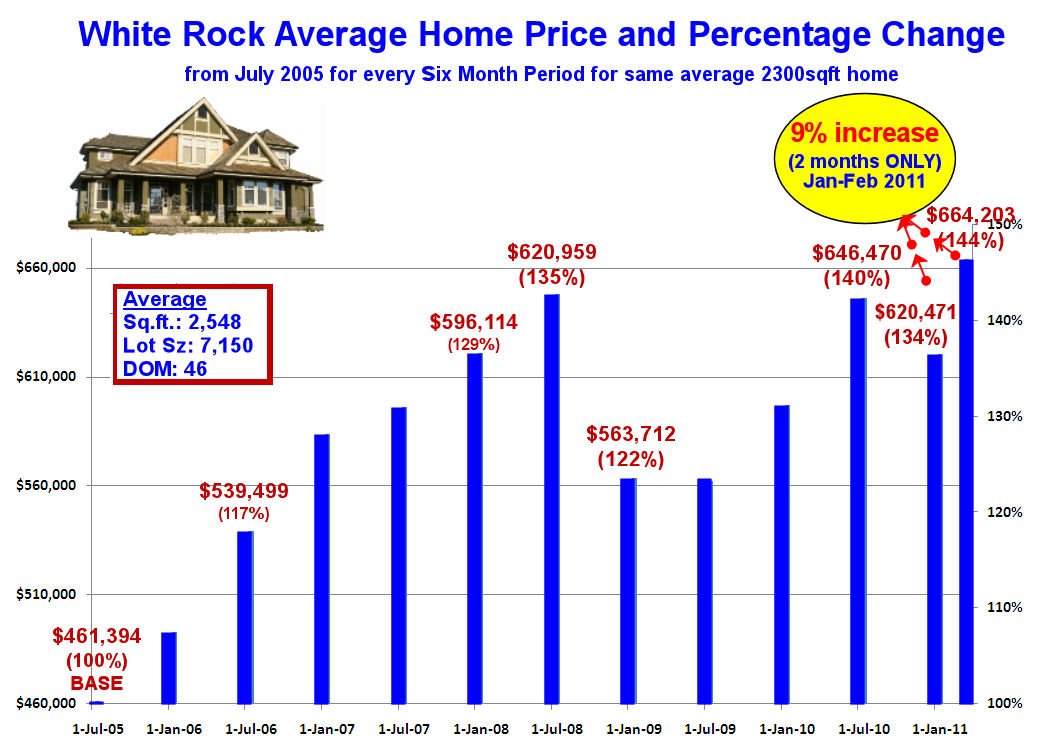

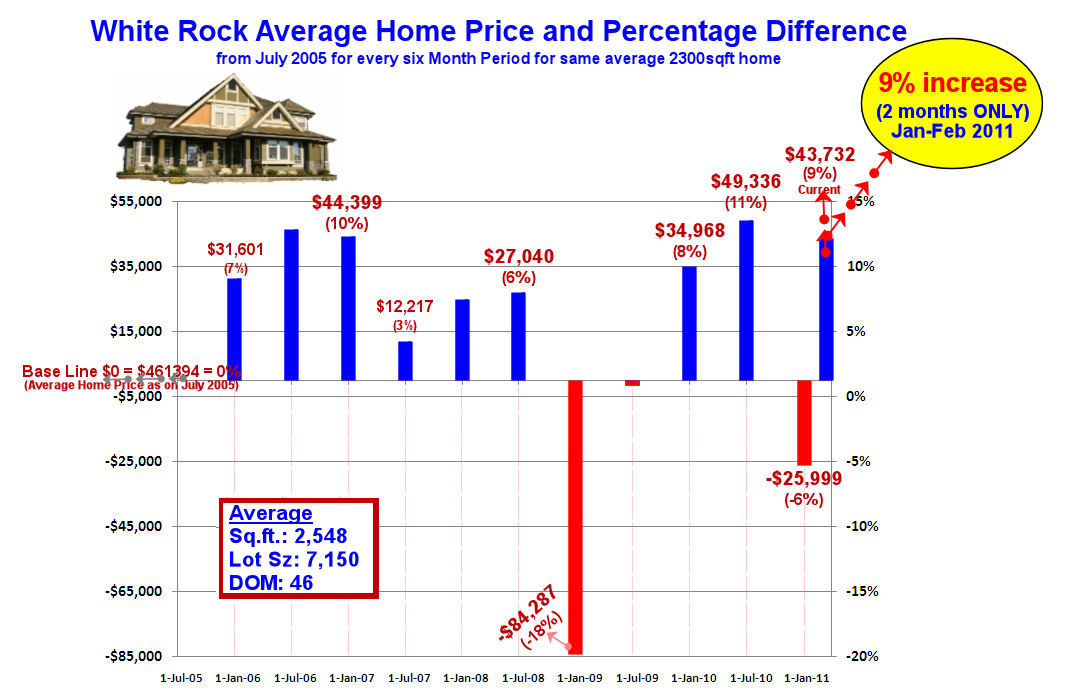

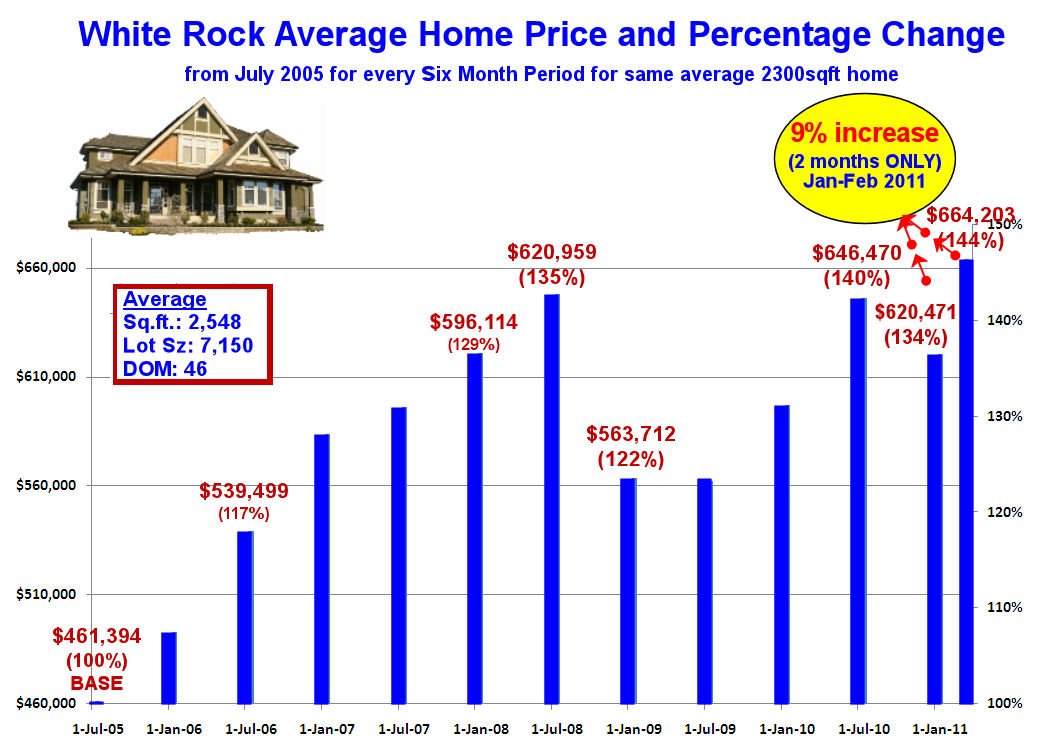

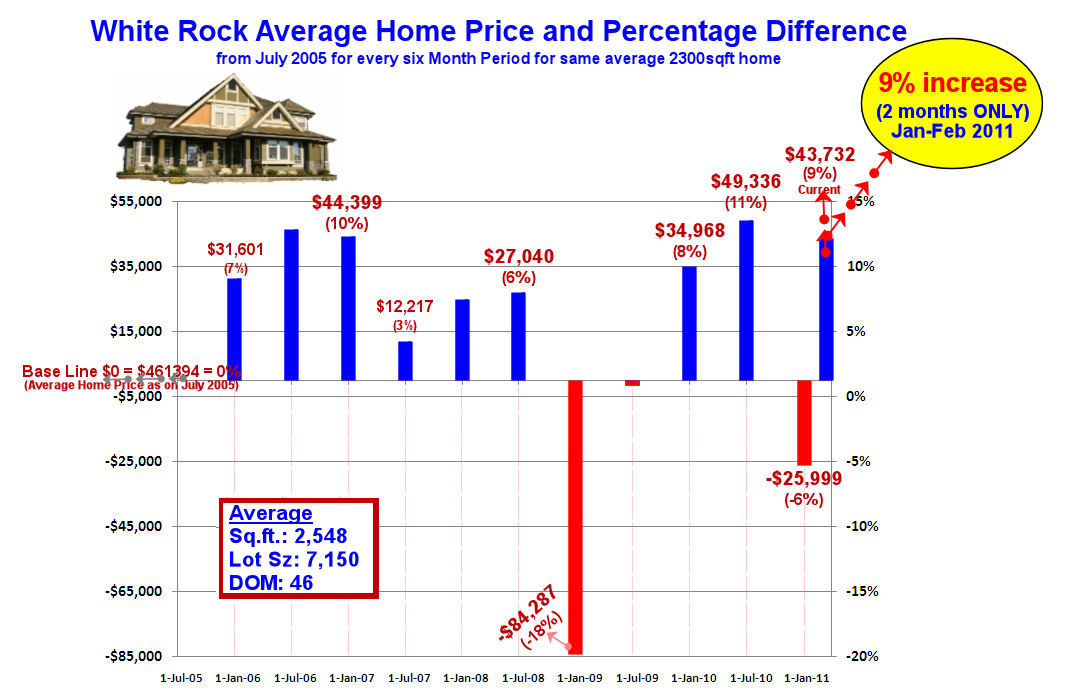

The White Rock residential market has jumped ~9% price increase , near a $43,700 for the average home* in just 6 short weeks with no end in sight.

Listen to the " Entrepreneur of the Week's" Bob Cooke, ReMax Progroup, Ladner, Richmond area does an interview on "The Chinese Buying Frenzy" as to how this price surge could affect your home value and how you can make informed decisions . Live podcast: click here

Feb 27 2011 w8c

White Rock has shocked our Real Estate industry with an all time price increase record 9% in just 6 weeks. Is it sustainable? Will affect your home valuation?

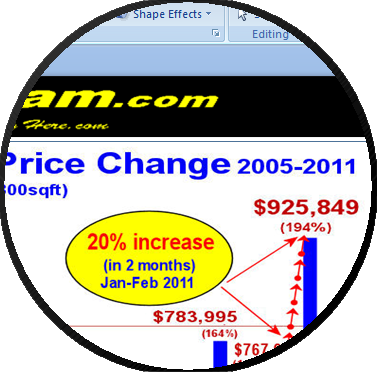

The fact is that are we have an increased buyer demand coming from mainland China and Canada's baby boomers deciding that White Rock is their dream retirement area.. It is our understanding that China has changed some government rules making many rich Chinese consider investing outside China. So as the story unfolds we had just experienced a quiet market in most of BC cities up until Jan 15th when thereabouts Chinese investors started arriving by the plane load. Previous to their arrival their agents pre-purchased many homes with assignment clauses and then drove and helicoptered them around the Richmond area and surrounding coastal areas including White Rock and they purchased many of these homes. IN general their have been very few new listings in the white Rock residential market in Dec and January. But he lighter than m=normal sales volume in December and January still caused upward pressure on the residential detached home prices because of not enough supply. Our Market Trend Index MTI (letting us see Month(s) into the future) our new home sales each month have exceeded our new listing for the month it has caused a record 20% average home price increase in just 2 months and a 33% price increase from our 2005 base price of $477,000.

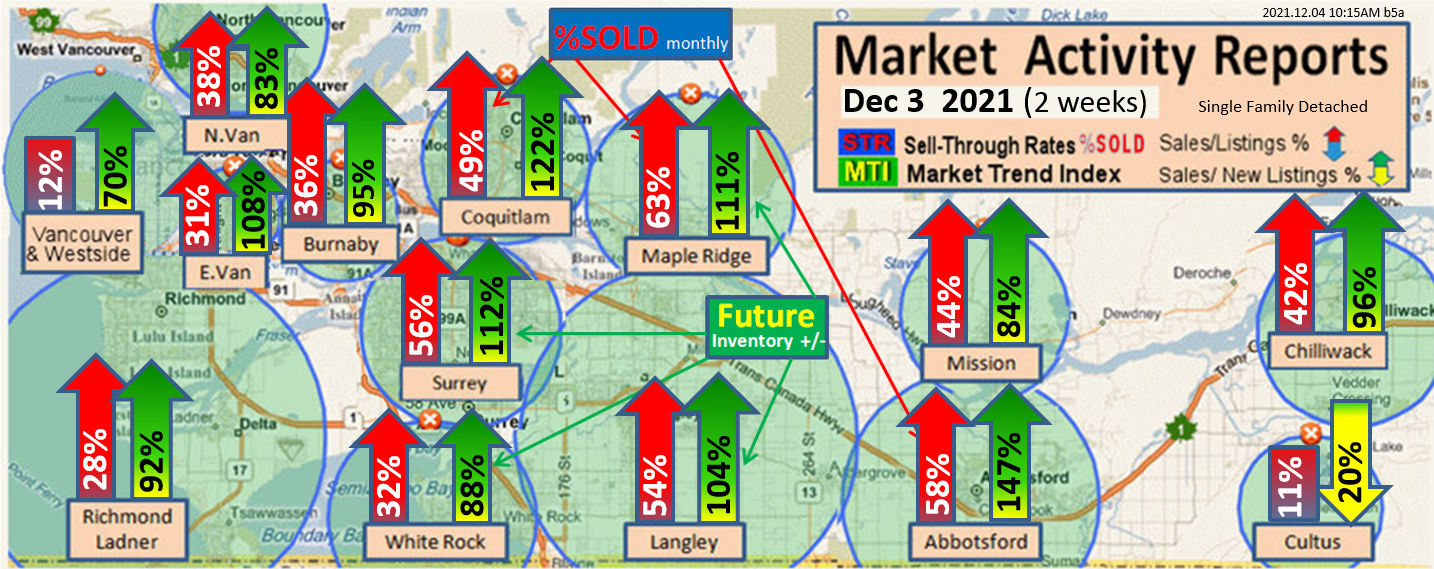

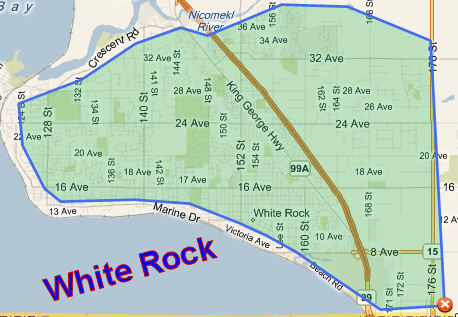

Meanwhile outside this narrow geographical corridor our general real estate market appears to reflex normal to below normal sales / listings volumes. NOTE : areas just 10 miles away from the activity of the Chinese Investment Corridor can experience a dramatically different market. So read and listen to the podcasts to see how this phenomena this could effect your market.

Advanced Market Reports: to access the current Supply-and-Demand and the next "30 Day Market Projections" reports Click Here.

.

Disclaimer: Market predictions are as such; predictions, market conditions are changing daily and you should consult with your local expert to confirm facts before making any decisions.

Index

-

Index

-

Price changes (semiannual))

-

Sales/Listings .. Current Supply Demand

-

Market Trent Index (MTI)

-

Study Criteria and data reports

-

Study Map

top

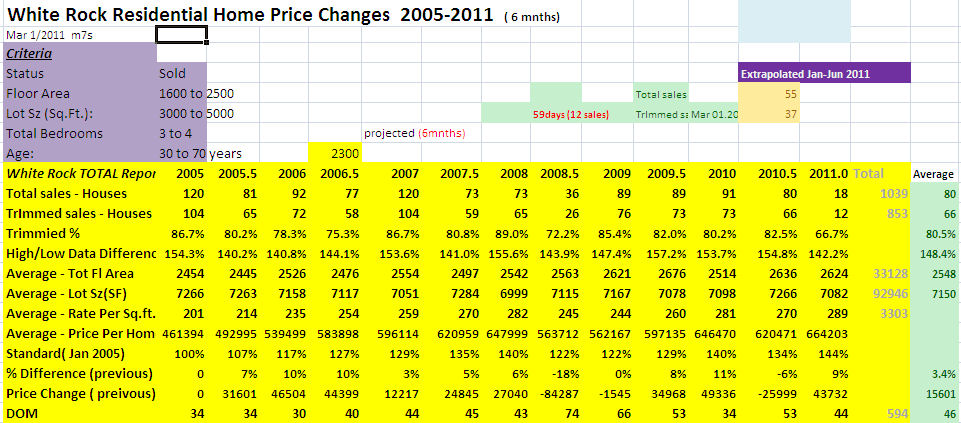

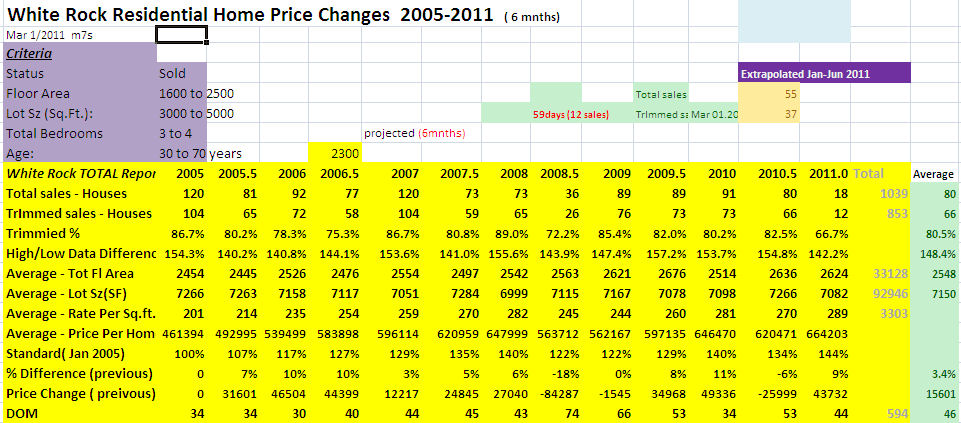

White Rock Sale prices 2005-2011

Study Criteria Home size: 1600-2500 sqft, Lot: 3000-5000 sqft, Age: 30-70 yrs, Bedrooms: 3-4 resulting in a sample size = 541/1361=25%

top

White Rock Average Home Price Difference 2005-2011

Six Month periods (2300 SqFt)

Study Criteria Home size: 1600-2500 sqft, Lot: 3000-5000 sqft, Age: 30-70 yrs, Bedrooms: 3-4 resulting in a sample size = 541/1361=25%

top

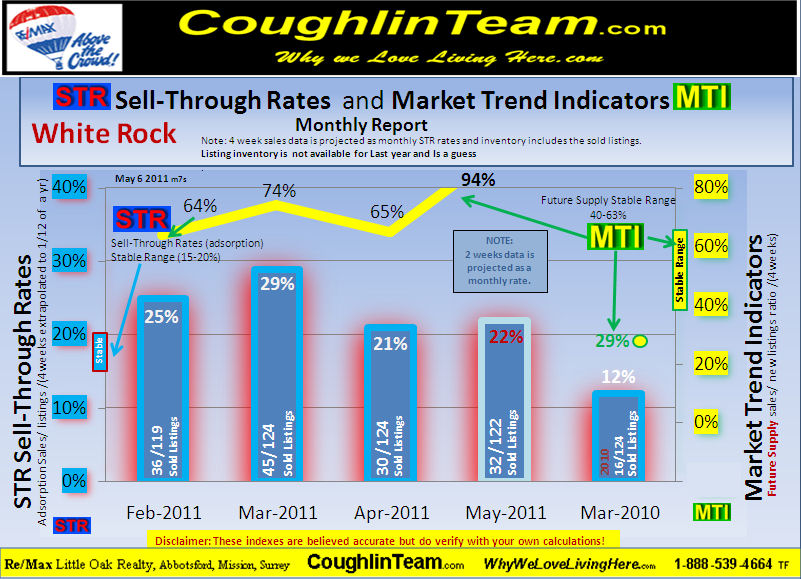

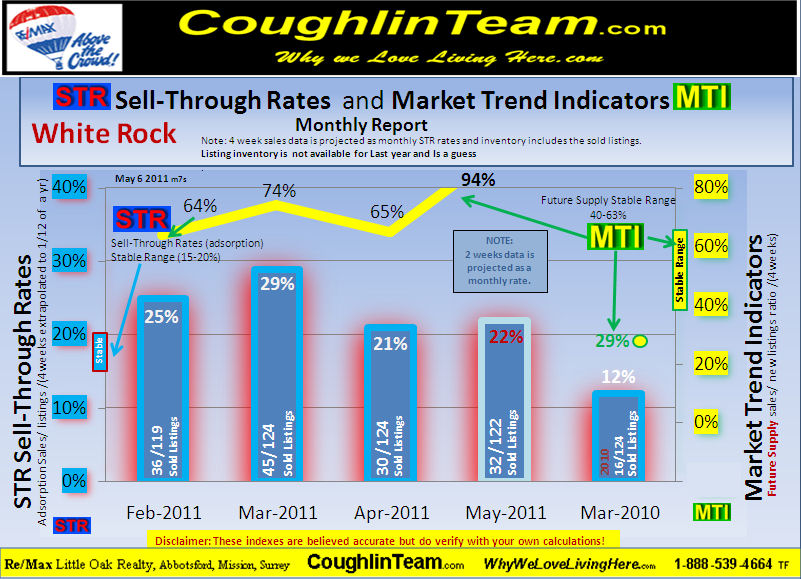

Market Trend Index: May 2011

Market Trends Index; is a predictive methodology of determining future supply and demand.

If you sell more than you list for a given month then soon you will run out of listings and have more demand than supply thus forcing prices up.

Stability ratios based on a 6 year study from 2005 to 2010 shows that we need about 65% sales-to-new-listing/mnth ratio to stabilize the market

In the White Rock area for the outlined search criteria we had only 2 listings at a time when we had a strong sell through of 14 sales, and then in January we had only 8 listing with a 12 sales. Both of the ratios are much higher than the 63% ratio needed for market stability and put a lot of upward pressure on home prices.

Now that their are more listing just coming on the market with a 94% MTI this could stabilize. The wild card is the high emotion of the current buying frenzy.

Study Criteria Home size: 1600-2500 sqft, Lot: 3000-5000 sqft, Age: 30-70 yrs, Bedrooms: 3-4 resulting in a sample size = 541/1361=25%

top

The Study Map Area

top

The Study Criteria and Research Data

Study Criteria Home size: 1500-3500 sqft,, Lot: 3800 7000 sqft, Age: 10-50 yrs, Bedrooms: 3-6 resulting in a sample size = 541/1361=25%

|